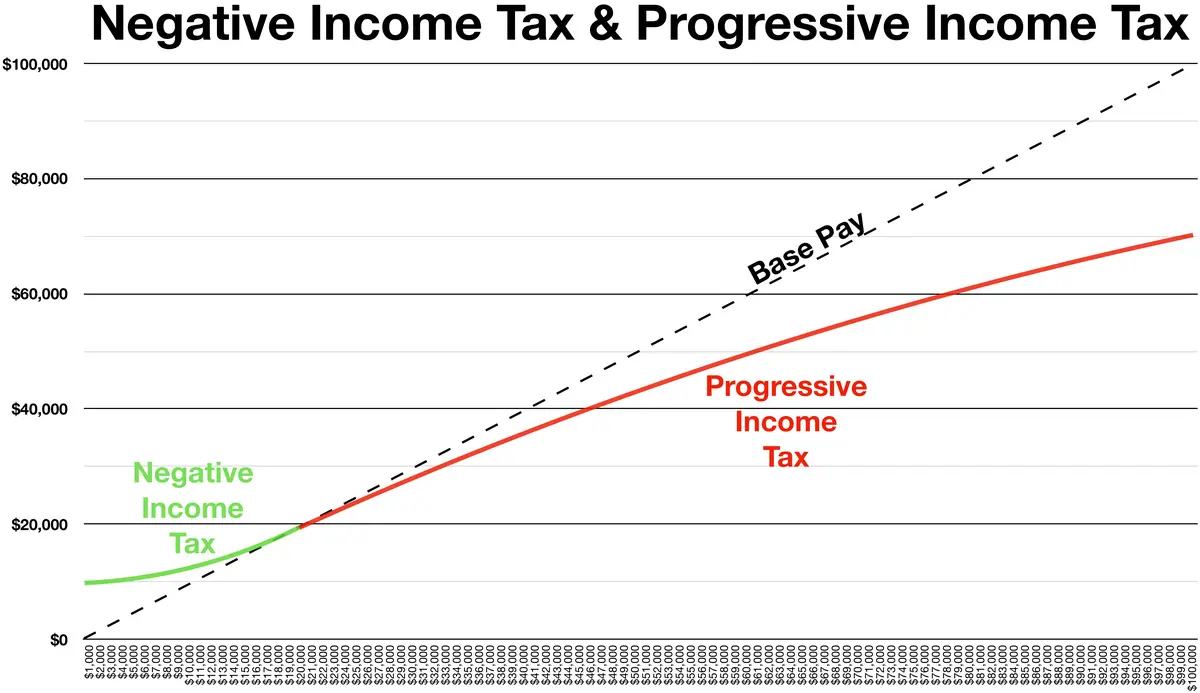

YSK: In economics, a negative income tax (NIT) is a system which reverses the direction in which tax is paid for incomes below a certain level.

YSK: In economics, a negative income tax (NIT) is a system which reverses the direction in which tax is paid for incomes below a certain level.