"Getting paid more money is for fools"

"Getting paid more money is for fools"

"Getting paid more money is for fools"

You're viewing a single thread.

Just in case anyone is curious about how it works...

Your entire income isn't taxed at the same rate. Each chunk of your income is taxed differently. The first 11k is taxed at 10%, the next 35k is taxed at 12%, the next 50k is taxed at 22%, and it continues on at different intervals after that. This person believed that going from 44k to 45k would then change their tax bracket and their gross income would be taxed at 22%, thus reducing their net income. This is false. Only the amount over the threshold gets taxed at the higher rate. Always take a raise if it benefits you.

This person was clearly joking. Look at their username.

Still too many who don't know this, it's best to explain to everyone. I've explained it to my mother several times, and she gets it, but then conveniently forgets about that when discussing politics.

I was straight up told getting kicked into a new tax bracket would cost me money when I started working back in the 90s. By someone 3x my age. I believed it, being a wide eyed moron. I didn't figure out progressive tax rates for like a decade after.

Just shitty one person could cost so many people so much opportunity in life.

I've heard of people who use this as an excuse to turn down overtime

I've tried to explain this to coworkers who claim to want overtime, but are afraid to due to this. They either don't understand, don't believe me, or don't really want to work OT.

It doesn't help that welfare does actually work this way.

I don't know the actual figures but my understanding is government assistance tends to work along the lines of "if you make less than $300, then the government gives you $100" so getting paid $350 is actually worse than being paid $290 for example, since going over the threshold cuts off the welfare completely.

I am surprised by the amount of professionally employed homeowning parental adults I have encountered that do not know this.

Let's make it even more simple with some fake numbers to make it super easy.

$0-$10,000 - taxed at 10%

$10,000-$20,000 - taxed at 20%

$20,000-$30,000 - taxed at 30%

If you make 9 and get a raise to 11, seems like you would now pay 20% on all that! But no.

The first 10 is still taxed at 10%, only the extra $1,000 gets taxed at 20%.

If you go to 31, again, the first 10 is taxed at 10, the next 10 is taxed at 20, and only the extra $1,000 gets taxed at 30%.

$10,000-$20,000 - taxed at 20%

Goll durnit, I know 10,000-20,000=-10,000! How I supposed to pay 20% tax on -$10,000?? Do they pay ME money?? Clearly everythin you said is BULLshit!

(This is a joke just to be clear :P)

If they receive subsidized benefits like food stamps or quantity for free health benefits, they could lose those though. There's a reason they call it the benefit cliff. My family stayed under that line intentionally for years and when decided to take raises to get out of that cycle, things were worse for a long time.

10k will get you over that hurdle in most cases unless it barely sneaks you over the benefits line. If you shoot past it though, go for it. Thresholds though, I know. Just don't want anyone not taking a raise due to a misread comment.

As a rule though: Stay updated on the max total assets you are allowed before benefits begin decreasing, and make sure you know what is weighted.

10k is slightly less than an increase of $5/hr in pay for a full-time hourly worker. That would likely be well over of 30% pay-bump for a person working the kind of jobs that usually keep them on those programs. -At least, it would be in my state.

I'm not saying you're wrong - I completely agree with you. But I have been in the position where, if I made 10 dollars less I would have paid more than 100 dollars less in tax. That just comes from the infuriating discrete tax "tables," instead of actually calculating the tax using a continuous formula.

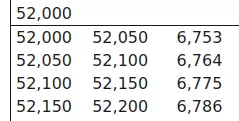

ETA: Apparently many here have never prepared their own tax return. Here is a sample of the tax table for 2023. The first two columns give a range of (adjusted) income, and the third is tax owed. Notice that someone who made $51,099 would pay $11 less in tax than someone who made just one dollar more. Admittedly that is less extreme that what I claimed above, but "back in the day" when I started paying taxes the tables went in much larger steps of income.

I mean, I get it, but you could also just look at it like getting an exceptionally good deal right before you hit the next table row.

Sure, but my point is that it is possible to make more money and then actually have less money because of taxes. It's just not for the reason in OP's post.